The entertainment landscape is buzzing with speculation following recent reports that activist investor Anson Funds Management has taken a strategic stake in Lionsgate Studios Corp. (NASDAQ:LION). The studio, known for blockbuster franchises like The Hunger Games and John Wick, has been in discussions with Anson about unlocking greater shareholder value. Central to these talks is the proposed separation of Lionsgate's studio operations from its Starz cable and streaming business, a move designed to simplify its structure and enhance its appeal as a standalone acquisition target. While the company faces challenges such as disappointing box office returns from Borderlands and a tough market for unscripted television, there are many inherent qualities that position it well for potential suitors in the ever-consolidating media industry.

Extensive IP Portfolio & Franchise-Driven Strategy

Lionsgate’s crown jewels are its intellectual properties (IPs) and long-running franchises. The studio’s vast content library has generated nearly $900 million in trailing 12-month revenue, underscoring its value as a cash-generating asset. The company is leveraging blockbuster franchises like The Hunger Games, John Wick, and Now You See Me, while also expanding into high-potential adaptations such as American Psycho, The Long Walk, and Twilight. Moreover, its upcoming Broadway adaptations, including Dirty Dancing and La La Land, and the development of a John Wick AAA game showcase its commitment to monetizing IP beyond traditional film and TV. These efforts ensure recurring revenue streams from a diversified asset base. Potential acquirers like Amazon or Apple, eager to bolster their streaming services with well-established franchises, could find Lionsgate’s IP portfolio immensely attractive, offering immediate content scale and franchise-building opportunities.

Starz Separation Enhancing Core Studio Focus

The planned separation of Lionsgate Studios from its Starz streaming and cable network business is a game-changer. Starz’s current integration has weighed down Lionsgate’s valuation due to the platform's slower-than-expected growth and international exit. However, Starz has shown signs of resilience, including multi-platform viewership records for shows like Power Book II: Ghost and successful partnerships with YouTube TV and BritBox. Post-separation, Lionsgate Studios would emerge as a pure-play content powerhouse with fewer operational distractions and a cleaner balance sheet. This move enhances its attractiveness to major studios or tech giants seeking a content-rich, vertically integrated production entity. Acquirers like Netflix or Disney could find the streamlined Lionsgate Studios an appealing bolt-on acquisition, strengthening their libraries and reducing their reliance on external production partnerships.

Global Distribution Capabilities & Strategic Partnerships

Lionsgate has built a robust global distribution network, ensuring its content reaches millions of viewers worldwide. Its established relationships with major streaming platforms and international broadcasters allow for seamless distribution of both library content and new releases. In addition, its recent partnership with AI company Runway reflects forward-thinking innovation, aimed at enhancing production efficiencies through cutting-edge technology. As streamers continue to globalize their reach, acquiring a studio with proven distribution channels could be a strategic move for platforms like Warner Bros. Discovery or Paramount Global. These companies could use Lionsgate’s infrastructure to support direct-to-consumer growth, especially in international markets where distribution capabilities are critical for subscriber expansion.

Final Thoughts

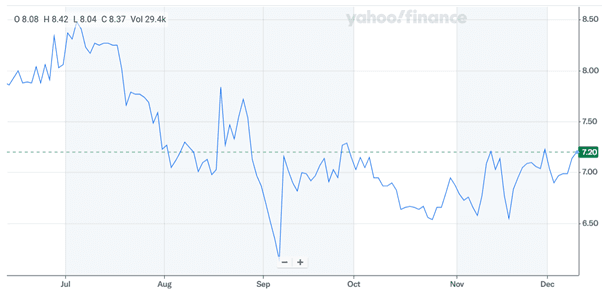

Source: Yahoo Finance

Lionsgate Studios’ discussions with Anson about exploring strategic alternatives have not had a significant impact on its stock price. The company is trading at an LTM EV/ Revenue multiple of 2.02x and an LTM EV/ EBIT of 34.52x which seems on the higher side especially given that it has a negative net income. We believe that Lionsgate’s strong IP portfolio, focus on separating its studio operations from Starz, and robust global distribution network position it as a compelling acquisition target. While the company must navigate industry-wide challenges like fluctuating box office returns and evolving TV production models, its strategic initiatives suggest a promising future. Overall, we see a decent chance of the company getting acquired or even unlocking value through a possible split in its operations.