WillScot Holdings (NASDAQ:WSC), a leading provider of modular buildings and portable storage solutions, has recently garnered attention from private equity firms. A Semafor report suggests that multiple PE players are considering acquiring the company, with at least one firm actively engaging bankers for a potential offer. This follows a series of developments, including the termination of a $3.8 billion acquisition of McGrath RentCorp (MGRC) in September due to regulatory hurdles. The company has also faced pressure from activist investor TOMS Capital Investment Management to initiate a strategic review, which has fueled speculation about its future. Despite challenges in the nonresidential construction market, WillScot has demonstrated resilience through strong margins and significant cost optimizations, positioning it as a lucrative target for private equity investors.

Strong Financial Performance & Cash Flow Stability

WillScot's consistent financial performance is a standout factor for private equity firms seeking predictable cash flows and high returns. The company reported an adjusted EBITDA margin of 44.4% in Q3 2024, near record levels, showcasing its ability to maintain profitability even in a challenging construction market. Over the last 12 months, adjusted free cash flow per share grew 13% to $3.12, reflecting its efficient cash conversion capabilities. Despite headwinds in nonresidential construction, WillScot has achieved steady pricing in its modular and storage segments, driven by its value-added products and services. Additionally, its ability to adapt to market conditions is evident in the $20 million variable cost reductions executed in Q3, building on $40 million in indirect cost takeouts earlier in the year. This flexibility enhances its margin trajectory, making it an attractive target for PE funds focused on cash flow generation and operational efficiency.

Diverse Product Portfolio With Growth Potential

WillScot has significantly expanded its product offerings to include climate-controlled storage, clearspan structures, and sanitation solutions, among others. These adjacencies complement its core modular and portable storage business, allowing the company to tap into new customer segments and end markets. The run rate for these new products doubled in 2024 and is expected to double again in 2025, highlighting their growth potential. The integration of Mobile Mini and WillScot's operations has created a unified platform that leverages cross-selling opportunities and enhances customer value. This diverse and scalable product portfolio not only increases the company’s total addressable market but also makes it an appealing investment for PE firms seeking growth avenues beyond the core business. Furthermore, these products align with macro trends in infrastructure development, disaster recovery, and temporary accommodations, adding resilience to its revenue streams.

Strategic Cost Management & Operational Efficiencies

WillScot’s disciplined approach to cost management and operational efficiencies is another key driver for its attractiveness. The company has streamlined its operations through technology and process improvements, such as the consolidation of field teams and the introduction of advanced digital marketing and customer service tools. These initiatives have optimized the order-to-cash process, improved customer satisfaction, and reduced operational costs. With a stable leverage ratio of 3.4x and $1.7 billion in revolver availability, WillScot has ample liquidity to support strategic investments and share repurchases. Its robust capital allocation strategy, which has returned over $2.1 billion to shareholders since 2021, demonstrates its ability to generate shareholder value while maintaining financial discipline. For private equity investors, these cost-saving measures and efficient capital allocation provide a clear pathway to enhancing profitability and realizing investment returns.

Resilient Business Model Amid Market Volatility

Despite facing a 14% year-over-year decline in nonresidential construction starts, WillScot has shown remarkable resilience. The company’s long-term leases with stable pricing have mitigated volume-related headwinds, ensuring steady revenue streams. Its modular business continues to benefit from mega projects and national accounts, which offset the softness in smaller, rate-sensitive projects. Additionally, the company’s focus on recurring revenue from value-added products has bolstered its financial stability. The ability to scale costs in line with demand, as evidenced by its rapid response to lower activity levels, further reinforces its resilient business model. With a strong presence in the U.S. and expanding adjacencies, WillScot is well-positioned to weather economic uncertainties, making it a strategic acquisition for PE firms looking to capitalize on long-term infrastructure and construction trends.

Final Thoughts

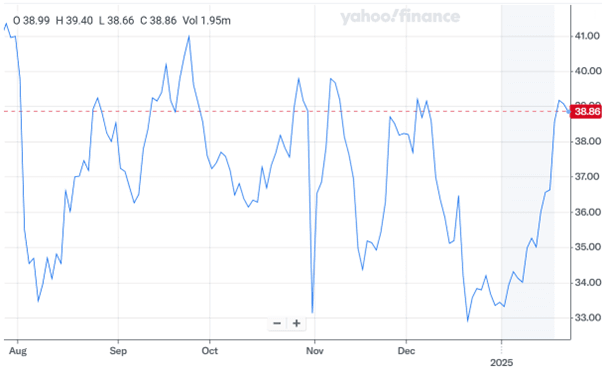

Source: Yahoo Finance

WillScot’s stock has had a rather topsy-turvy trajectory over the past 6 months despite its strong financials. The company’s stock is more on the expensive side with an LTM EV/ Revenue multiple of 4.60x and an LTM EV/ EBIT of 19.29x. We believe that the company’s diverse product portfolio, operational efficiencies, and resilient business model make it a prime target for private equity funds. Its ability to adapt to market dynamics and leverage growth opportunities in adjacencies positions it as a valuable asset in a consolidating industry. As the company navigates ongoing market pressures and strategic decisions, its future remains a topic of keen interest for both private equity and public market investors.