With the global population expected to touch the 9.5 billion mark by 2050 and the limitations with respect to land for food cultivation, it has become more and more essential to find a stable and economical source of protein. Many new technologies are being developed within the domain of food-tech in order to cater to this need, particularly within the seafood domain. Land-based cultivation of seafood and aquaculture is one of the fastest emerging technologies and could well become the solution to this global food crisis in the long run. Our stock pick for the day is a company that operates within this domain and is engaged in land-based RAS manufacturing and aquaculture consulting company, providing opinions, technology transfer, and aquaculture project management services to new and existing aquaculture projects – Nocera, Inc. (NASDAQ:NCRA).

Company Overview

Nocera, Inc. along with its subsidiaries, operates in the seafood domain and is known to design, develop and produce land-based recirculation aquaculture systems (RAS) for fish farming in Taiwan. The company also builds, manages, and runs aquaculture facilities. Additionally, it offers consulting, technology transfer, and project management services for aquaculture management businesses, both new and old. Its Recirculating Aquaculture Systems contribute to environmental preservation by reducing pollution from excessive fish concentration, which frequently occurs in fish farms built in natural inland waterways. The RAS tanks at Nocera have an annual fish production capacity of 20,000–30,000 lbs. The company’s corporate headquarters are in Taiwan’s New Taipei City. The company which was established in 2014.

The RAS Model

Nocera has introduced their next-generation commercially operational Recirculating Aquaculture Systems (RAS) to improve productivity and sustainability in commercial aquaculture. Its land-based RAS is a sizable, economically viable, and environmentally responsible way to get clean fish on the table and clean water back to the people. Moreover, the next-gen tank design has a better oxygenation system, allowing for about 50% more fish to be cultivated in the tanks and more convenient fish transport. The company’s RAS recycles 90 percent of the water and reduces the area of land required for the fish farm. Hence, one can harvest up to 72 times the production using the same hectares of land making it a highly feasible solution for the food crisis. RAS is produced by the company for a variety of freshwater and saltwater fish, including tilapia, bass, crayfish, perch, crab, and abalone. The management believes that its services will contribute to a better world in the years to come because they are affordable, lessen water pollution, recycle fish waste, and are cost-competitive.

It is worth highlighting that the Governments closely regulated the fishing and fish farming industries in the Asia Pacific region by allowing fish farmers to set up fishnets in public bodies of water, such as dammed rivers, lakes, and other bodies of water. Both for domestic demand and exports, it is the main source of freshwater fish. The industry’s netting and harvesting methods, however, are unprofitable and cause issues with ongoing supply. The company sees that it is a great time to advocate for land-based RAS in order to address the issue of sustainability. Interestingly, Nocera’s RAS systems do not require to be used for high value species or purely by large corporations, but are well within the grasp of relatively small aquaculture players, producing a wide range of species. For small stakeholders, Nocera’s newest tank can produce up to 22,000 lbs. of catfish or tilapia per year, which would bring in between $25,000 and $50,000 in the U.S. (process or live). Although Nocera’s aquaculture operation is currently located in Taiwan, the company also has expansion plans in the U.S. market where it would be an excellent low-cost entrant.

Acquisition-Led Growth

Nocera has been seeking viable acquisition targets to expand its top-line. The company recently acquired the Taiwanese construction companies Xin Feng Construction Co. and Shunda Feed Co. buying a 100% controlling interest in each of them in exchange of a total of 1 million shares of restricted stock. These agreement with Xin Feng Construction and Shunda Feed are a significant turning point for the company. As a supplier of aquaculture food in the Taiwanese market and to better develop their land-based recirculating aquaculture systems, these acquisitions give the company a strategic integration advantage. The management feels that by doing this, it has improved its ability to support both the development of fish farms owned and run by the company as well as the construction efforts of its clients. Nocera will also be in a better position, in the opinion of management, to establish itself as a major supplier to other fish farm operators. Nocera plans to offer technical consulting and related services to both businesses. In addition, it can use management input to steer the activities that have the biggest impact on the financial health of both acquisitions.

Final Thoughts

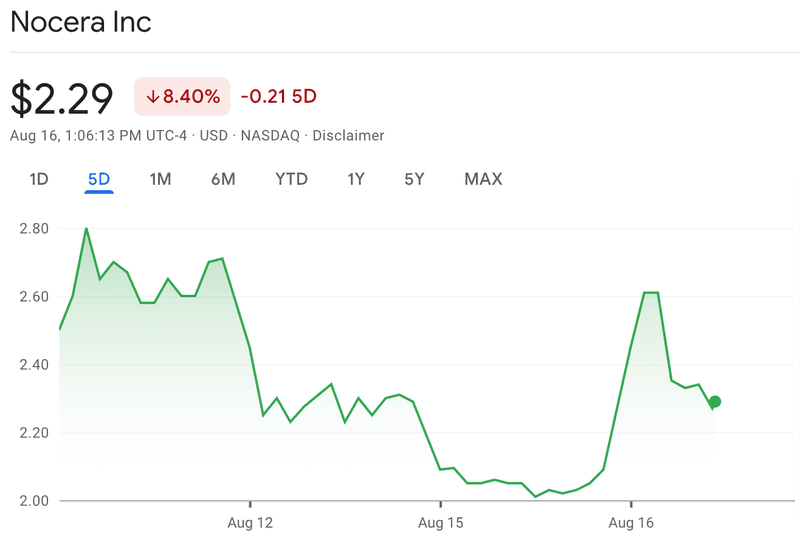

Nocera’s stock has been hit along with broader markets but its fundamentals remain solid. If we see the company’s financial statements, we see a very low indirect, fixed cost burden, barely around the $1 million mark and this is because the company’s entire back-end operations are based in Taiwan. While it did incur one-time costs associated with its listing last year and reported a net loss, the situation should change completely in 2022. It is critical to highlight the fact that Nocera’s revenues grew from $1.19 million in 2020 to $9.95 million in 2021 and its trailing twelve-month revenues are as high as $11.28 million. Its gross margin is also expanding. The stock is currently trading at an enterprise-value-to-revenue multiple of 4x which appears fair but given the rate at which the company’s revenues are growing, its stock price should also appreciate rapidly. We believe that the company’s RAS technology is particularly solid and widely scalable. We are bullish on Nocera and believe that the company is a solid investment proposition for our readers at SmallCapsDaily.