Novavax Inc. (NASDAQ:NVAX) has been one of the most frequently trending stocks on Reddit ever since the Covid-19 pandemic. The fact that it is constantly in the spotlight, has often resulted in extreme volatility in the company's stock price with headlines often pushing its stock price towards the $10 mark, only to see it fall back again. The promise of a vaccine in a world grappling with a global crisis was a lucrative narrative for many investors. However, as the pandemic landscape shifts and the demand for COVID-19 vaccines wanes, the question arises: Is Novavax still a worthy investment opportunity? Let us find out!

Novavax – Business Overview

Novavax, Inc., is a biotechnology company headquartered in Gaithersburg, Maryland, with a mission to enhance public health through the research, development, and commercialization of vaccines designed to combat severe infectious diseases. Their vaccine platform employs a combination of recombinant protein techniques, nanoparticle technology, and their proprietary Matrix-M adjuvant to bolster the immune response. Novavax concentrates its efforts on addressing pressing global health challenges, including the development of vaccines for COVID-19, influenza, and the dual threat of COVID-19 and influenza. The company has brought to market a COVID-19 vaccine, NVX-CoV2373, sold under various brand names such as Nuvaxovid, Covovax, and Novavax COVID-19 Vaccine, Adjuvanted, intended for adult and adolescent populations, serving as both a primary vaccination series and for potential homologous or heterologous booster administrations. Additionally, Novavax is actively engaged in advancing product candidates for respiratory syncytial virus and malaria.

Why Is Novavax Trending On Reddit?

Novavax had seen its fortunes tied to the COVID-19 vaccine market. The company's alternative vaccine, while once in high demand, is now facing challenges. With declining sales and the dwindling demand for COVID-19 vaccines, Novavax's long-term prospects are being called into question.

One of the critical issues facing Novavax is its lack of a proprietary drug. In a market where larger biotech companies dominate, Novavax's alternative vaccine may struggle to maintain relevance. Moreover, Novavax's reliance on Advanced Purchase Agreements (APAs) has propped up its sales, but these agreements are now winding down. This leaves the company vulnerable to market forces.

While Novavax has made efforts to control costs and reported a profit in the second quarter of 2023 (the main reason why it was trending on Reddit), the future remains uncertain. Analysts are revising their sales forecasts downwards, and the company's stock faces resistance at the $10 mark. With its long-term outlook remaining bleak, it seems like there is little in the company for investors.

Doubts Over Novavax's Ambitious Plans

In a sea of promises and optimistic forecasts, Novavax's ambitious plan to release an updated product for the imminent fall vaccination season seems to teeter on the precipice of uncertainty. While they boast of a so-called "robust" strain change strategy and are purportedly gearing up for commercial readiness, one can't help but wonder if their preparations are indeed adequate. Despite their claims of possessing a competitive product profile and having enough supply in hand, one has to question the viability of their regulatory filings for authorization in the U.S. The entire exercise appears to be in flux, with only preliminary preparations made for submissions in other key markets.

From a financial standpoint, Novavax seems to be treading on thin ice. While they have reported a revenue exceeding $500 million for the first half of the year, their commitment to reducing spending raises eyebrows. They speak of an enhanced partnership with SK Bioscience and a subsequent equity investment. But the removal of a significant outstanding liability from their balance sheet by 2023 – all these measures hint at a possible underlying financial instability. The mention of "global restructuring" and cost-cutting plans only intensifies these doubts.

Expanding beyond the Nuvaxovid vaccine, Novavax's attempts to capitalize on their technology platform appear fraught with challenges. While the company is keen on addressing the need for combination vaccines, the emphasis on potential partnerships seems more like wishful thinking rather than a solid strategy. Furthermore, collaborations for malaria vaccine research, though commendable, come with their own set of challenges.

Final Thoughts – Is Novavax Worth The Risk?

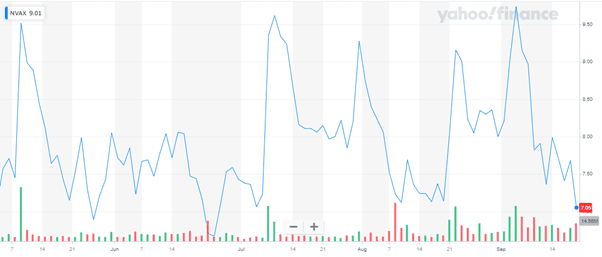

Source: Yahoo Finance

We can see the volatility in Novavax's stock over the past few months and the strong resistance around the $10 is also evident in the chart. As we evaluate Novavax as an investment opportunity, it becomes clear that the company faces significant challenges ahead. The declining demand for COVID-19 vaccines and the absence of a proprietary blockbuster drug pose substantial risks. Novavax's management has also been candid enough to acknowledge the immense execution risks looming large. Their success, precariously balanced as it is, hinges on adeptly navigating the convoluted vaccination landscape. Overall, we believe that given all these facts, Novavax's stock is best avoided at least until the management can come up with some material progress in its research efforts.