In the high-stakes world of electric vehicles (EVs), Sigma Lithium Corporation (NASDAQ:SGML) has emerged as a potential linchpin. The Brazilian lithium producer's recent talks with Chinese EV behemoth BYD (OTCPK:BYDDF) have sparked a flurry of investor interest, positioning Sigma Lithium as a tantalizing investment opportunity. Sigma Lithium's strategic importance lies in its Grota do Cirilo project, a significant project in the lithium market. The interest in Sigma Lithium isn't isolated to BYD. Industry titans like Tesla (NASDAQ:TSLA), Volkswagen (OTCPK:VWAGY), Chinese battery maker CATL, and others have shown keen interest, as reported by Bloomberg and Brazil's Exame. Let us take a closer look at the company and evaluate the reasons behind the recent hype.

What Does Sigma Lithium Do?

Sigma Lithium Corporation, a prominent player in the lithium industry, specializes in exploring and developing lithium-rich deposits across Brazil. The company boasts full ownership of several significant properties including Grota do Cirilo, Genipapo, Santa Clara, and São José. These properties collectively span 29 mineral rights and cover an expansive area of about 185 square kilometers, strategically located in the Araçuaí and Itinga regions of Minas Gerais, a state in Brazil. Catering primarily to the global electric vehicle industry, Sigma Lithium plays a crucial role in the supply chain of this rapidly growing sector. Initially known as Sigma Lithium Resources Corporation, the company underwent a rebranding in July 2021, adopting its current name, Sigma Lithium Corporation.

Operational Efficiency & Cost Leadership

Sigma's position as one of the lowest-cost producers of lithium concentrate globally is a critical driver for its growth in the coming years. This cost leadership is a result of several strategic decisions and operational efficiencies. The company has adopted dense media separation (DMS) for processing, coupled with the use of inexpensive renewable power, contributing to lower operational costs. This approach not only ensures high-purity lithium production but also significantly reduces the cost of production. Sigma's ability to maintain low costs is pivotal in an industry characterized by fluctuating lithium prices. Their operational resilience, as demonstrated by the ability to generate consistent revenues and maintain cash flow regardless of market conditions, provides a competitive edge. The company's aim to environmental sustainability through zero-carbon, zero-tailings, and chemical-free production processes, while still maintaining profitability and low operational costs, is remarkable. This unique blend of operational efficiency and cost leadership makes Sigma a resilient player in the lithium market, capable of thriving in various price environments. As the EV market grows and the demand for sustainable and cost-effective lithium increases, Sigma's operational efficiencies and cost leadership could significantly influence its stock value and appeal to investors.

Superior Product Quality & Market Positioning

Sigma Lithium Resources Corporation's emphasis on producing a superior quality lithium product is a major factor that could influence its growth in the coming years. The company's Triple Zero Green Lithium, characterized by zero carbon, zero tailings, and no use of toxic chemicals, sets a high bar in the lithium industry. This product not only appeals to environmentally conscious stakeholders but also offers significant cost savings to downstream clients, such as battery and car manufacturers. The high purity, low alkaline content, and low impurities like iron oxide and mica in Sigma's lithium concentrate translate into substantial cost advantages for clients. This quality advantage is particularly relevant as the European Union moves towards stricter environmental regulations for battery production by 2026. Sigma's ability to provide a product that meets these stringent requirements positions it favorably in the market. Moreover, the demand for Sigma's lithium is bolstered by its recognition as a brand, especially among clients looking to source sustainable and high-quality materials. The company's strategic focus on delivering a product that not only meets but exceeds market standards in terms of quality and environmental impact could significantly drive its market share and stock value, especially as global demand for sustainable and high-quality lithium products continues to rise in the EV and renewable energy sectors.

Expansion & Increased Production Capacity

Sigma Lithium's CEO, Ana Cabral Gardner has emphasized the successful ramp-up of Sigma's Greentech Plant, achieving 90% throughput and consistently shipping 20,000 tonnes of high-quality Triple Zero Green Lithium concentrate monthly. This ramp-up is crucial, considering the immense demand for lithium, driven by the global shift towards electric vehicles and renewable energy sources. Sigma's expansion isn't just about volume; it's about maintaining the highest quality standards in lithium production. The company has also announced plans for further expansion, motivated by the excessive demand for its product. This expansion includes the development of additional phases in their mining projects, potentially increasing the total mineral resource to 130 million tonnes. The successful execution of these expansion plans will likely enhance Sigma's production capabilities and market share, making it a more attractive investment. The company's ability to scale up organically, coupled with strategic decisions regarding engineering and construction partnerships, underscores its vow to growth and efficiency. As the EV market continues to expand and the demand for lithium rises, Sigma's strategic expansions and increased production capacity position it as a key player in the industry, potentially driving its stock in the coming years.

Final Thoughts

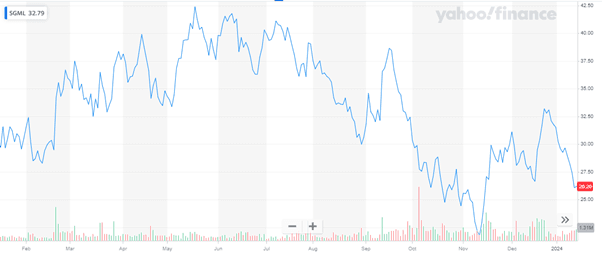

Source: Yahoo Finance

As we can see above, there has not been much of a market reaction to the news around Sigma Lithium and BYD. It is important to highlight that the discussions, detailed in an interview with BYD's Brazil chair Alexandre Baldy, hint at various possibilities, including supply agreements, joint ventures, or even an outright acquisition of Sigma Lithium, which could mean a huge upside for investors. Although details remain speculative, the mere possibility of such a deal has put Sigma Lithium under the investor's microscope. Adding to the intrigue, Sigma Lithium's CEO Ana Cabral-Gardner met with Baldy in Sao Paulo, further fueling speculation about the potential outcomes of these talks. For investors, Sigma Lithium represents a unique proposition. Amidst the backdrop of a potential acquisition and the surging demand for lithium in the EV industry, the company stands at a crossroads of opportunity and growth. With the global EV market on an upward trajectory, as evidenced by BYD's record sales of 3.02 million electric vehicles in 2023, we believe that Sigma Lithium certainly deserves a place in your investor watchlist.